Table of Content

If you’re self-employed and work from home, don’t let the idea of filling out Form 8829 scare you away from taking advantage of the home office deduction. You can always opt for the simplified method if you don’t want to deal with tracking your actual expenses. In tax year 2013, the IRS introduced a simplified option to calculate the deduction for home offices, as opposed to their more in-depth regular method.

Get help from a Certified Public Accountant or other licensed tax professional to make sure you calculate your home-office deduction correctly. You can’t carry over losses from the prior year in which you used an actual-expenses deduction. For example, if the home office where you conduct your business is 155 square feet, multiply that by $5. Jean Murray, MBA, Ph.D., is an experienced business writer and teacher who has been writing for The Balance on U.S. business law and taxes since 2008. For both methods, the home office deduction can only be used if the portion of the residence is used exclusively and consistently for business purposes.

What Is the Home Office Deduction?

If your home office expenses are more than your business income for the year, your deduction will be limited, as you cannot make your Schedule C income go below zero using business use of home expenses. Due to the Tax Cuts and Jobs Act of 2017, those who work for an employer in W-2 positions are no longer eligible for the tax break. While more people have been working from home, not everybody will be able to take advantage of the home office tax deduction. According to CNBC, this tax break is for those who are self-employed, freelancers, independent contractors or gig workers. NerdWallet strives to keep its information accurate and up to date.

Ideally, the space will be an open space or basement that is separated from the rest of your home. For an IRS audit, you need to prove that your home office is purely for business purposes. This form will walk you through the steps to calculate the percentage of your work-from-home that you can charge for use in your business. The actual cost method requires more effort and records management throughout the year, but in most cases, the deductions are higher. Self-employed people with a dedicated home office can fill out home office deduction form 8829 to request a tax credit for their work-from-home business use.

How Can Deskera Payroll Help?

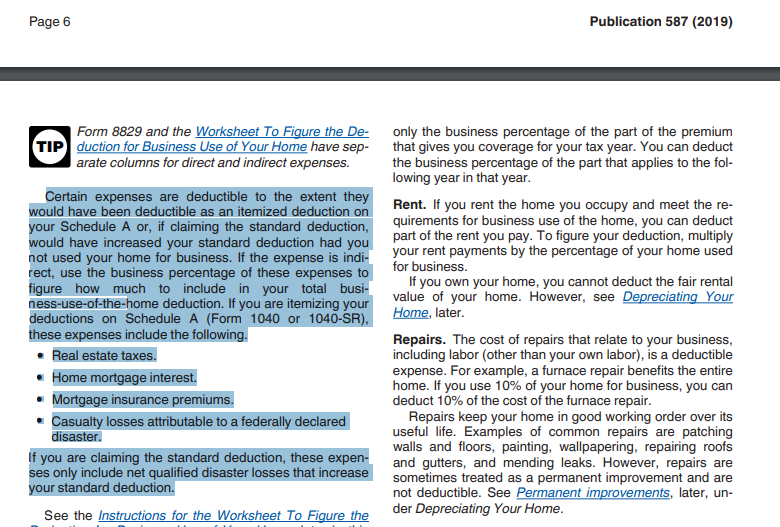

For example, if you use your car for business or rent equipment to use in your business, those costs could be deductible. If you run a home-based daycare business, there are a few extra lines to complete. You may need to use a special method to calculate your deduction, too. Check out the IRS Instructions for Form 8829 if you want more information on completing this form for a daycare. Since you use 10% of your home (2,000 total square feet / 200 home office square feet), your home office deduction using the regular method would be $800 ($8,000 x .10). The home office tax deduction is easy to claim but can be hard to defend.

You can enter mortgage interest here only if you do not request a standard deduction. Analyzing the deduction amount, line 10 details how to calculate the amount. Home office tax credits are easy to claim but can be difficult to defend. Many working Americans, even those who legally work from home, do not have a designated dedicated area dedicated to business.

When Would You Need to File IRS Form 8829?

The instructions for Form 8829 document from the IRS provides even more detailed guidance for each line item. In addition, taking the deduction could make it more difficult to sell your home in the future, if you own. That's because you can depreciate the value of your home office, which could create a tax event later when you sell. While employees who now work remotely may feel like they're missing out, the home-office deduction isn't generally leading to outsized savings for those who take it. There may be some confusion, as the home-office deduction was previously allowed for employees. The Tax Cuts and Jobs Act of 2017, however, banned such workers from taking the deduction from 2018 to 2025.

The regular method allows for carrying over the deduction for eligible filers. Our Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they know it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. To claim the home-office deduction in 2021, taxpayers must exclusively and regularly use part of their home or a separate structure on their property as their primary place of business.

Where does the home business deduction amount go on my Form 1040?

One way to do this is to keep careful records and file Form 8829 with your tax return, but by doing this you can calculate and claim your home office deduction and save money on your taxes. While the regular method requires accurate records, the IRS has a handy worksheet to get taxpayers on track if expenses exceed total income, and only some of them can be deducted. The simplified method described in more detail below eliminates the need to submit home office deduction form 8829 and instead takes you directly to Schedule C, which is the sole proprietor's income tax form. The COVID pandemic has opened avenues for many to work from home, and one of the many benefits of working from home is the ability to deduct legitimate expenses from taxes. The downside is that work from the housing tax deduction can be abused very easily because of which the Internal Revenue Service tends to scrutinize the tax return quite strictly. Using the regular method means you’ll have to maintain records of your expenses.

The major advantage of this deduction method is that you don’t need to itemize expenses and do complicated calculations. “Regular use” means you use that space on a regular basis, not just occasionally or incidentally. For example, if you use space as a home office where you go every month to pay bills, that’s regular use. But using it only once a year to prepare your tax return probably wouldn’t apply.

This includes a place where you greet clients or customers, conduct your business, store inventory, rent out or use as a daycare facility. You can use the simplified method in one year and the actual-expenses method in a later year. In this case, you must calculate the depreciation deduction for the later year. Keep in mind that the requirements for who qualifies for the home office deduction doesn’t change based on which deduction method you use. You can’t deduct depreciation for the part of your home used for qualified home business use if you use the simplified deduction method. However, you can still claim depreciation on other assets used for your business if you use the actual expenses method.

You can’t depreciate the cost or value of the land your home is on, but you can depreciate the portion of property taxes and mortgage interest for this business-only area. First, calculate the percentage of your home-office area used for businesses by dividing the total home area by your office area. Let’s say your total home area is 1,800 square feet and your home-office business area is 396 square feet. The home business space to use for calculations is 22% of the home space. The actual-expense deduction is used by businesses that have a larger space than 300 square feet or who want to get more deductions than the simplified method gives. If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as mortgage interest, insurance, utilities, repairs, and depreciation for that area.

The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return. With more people working from home than ever before, some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year. Home office deduction Form 8829 is a valuable deduction for entrepreneurs who use their homes as their primary place of business. It is important to keep accurate records to fill out home office deduction form 8829 appropriately.

Good Company Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

Small-Business Grants: Where to Find Free Money

This may influence which products we write about and where and how the product appears on a page. Note that the two lists above do not reflect expenditure that is necessarily deductible. The lists reflect only the types of expenditure that may typically be incurred in relation to maintaining a home office. For example, if you are open 8 hours a day, 200 days a year, multiply 200 by 8. The product is 1,600, which is the number of hours you have spent at your home for business. The amount you can depreciate depends on what percentage of your home you spend on your business.

If you don’t run a daycare, lines one, two, three and seven are going to be the only lines you use in this section. You’ll take the square footage of your home office and divide that by the square footage of your whole house. That gets you the business percentage that you’ll use for the rest of the form. For example, if your home is 1,000 square feet and your home office is 100 square feet, you use 10% of your home as part of your business. You’ll use this percentage when it comes time to calculate how much of an indirect expense, like your rent, should be able to be taken as a deduction. If you run a business out of your home or have a home office, you might be able to take a home office deduction on your tax return.

No comments:

Post a Comment